Best Medicare Supplement Plans in New Jersey

If you are searching for the best Medicare Supplement companies in New Jersey and you’re curious about their monthly premiums, future rate increases, and customer service, today I’ll shed light on what I believe are some of the top carriers in the state.

For over 15 years, I’ve been helping people understand and compare Medicare plans.

Let’s take a look at some of the topics I’m going to cover today:

- Top Medigap companies

- Monthly premiums

- Top Medigap plans

- Plan G vs Plan N

- Rate increase history

I’ll also compare Medigap vs. Medicare Advantage – and hopefully help you understand that Medigap is the best choice for coverage.

Let’s jump right in.

The first thing I want to mention is that all Medigap plans are standardized. So, whether you’re looking at Plan G or Plan N, it doesn’t matter what company you pick.

For example, Plan G from UnitedHealthcare offers the same benefits as Plan G from Horizon Blue Cross Blue Shield. Both plans work alongside Original Medicare to provide identical coverage, so you’ll get the same protections no matter which provider you choose.

It’s also important to note that all companies have entry-level rates, and rates will increase over time. This is unavoidable.

I will explore rate increase history later and give you more insight into what to expect with historical trends.

Let’s start with #1 on my list of Medigap providers in New Jersey – UnitedHealthcare.

#1. UnitedHealthcare

UnitedHealthcare is number one because of its sheer market size.

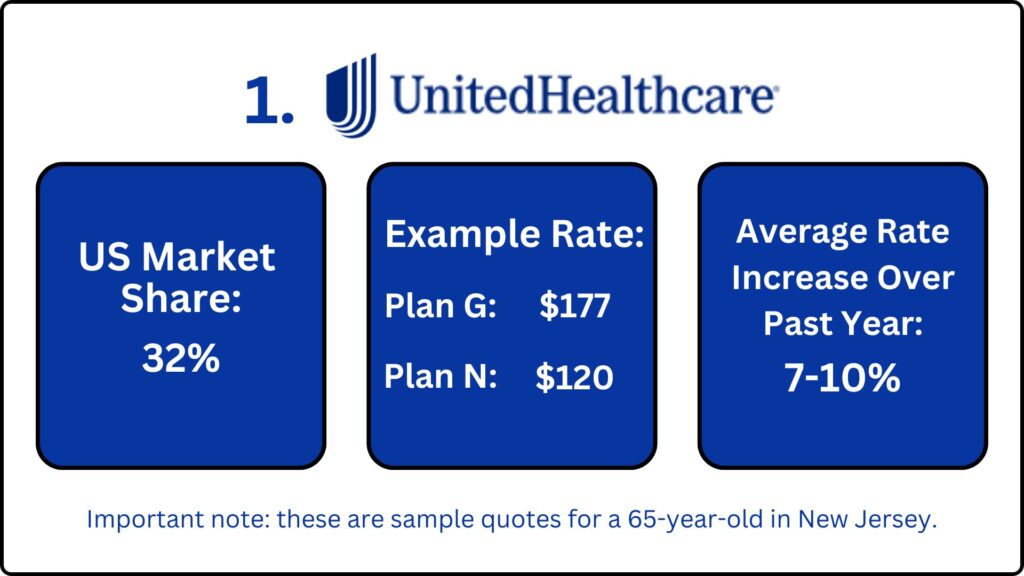

UnitedHealthcare is probably the biggest provider of Medicare Supplement plans of any carrier in the United States, with a market share of roughly 32%.

Note: This market share data is national, not specific to New Jersey itself.

For a 65-year-old male in New Jersey, sample monthly premium rates for Medigap plans are as follows:

- Plan G is approximately $177 per month. It is one of the most comprehensive options available, covering nearly all out-of-pocket Medicare costs except for the Part B deductible.

- Plan N is more budget-friendly at about $120 per month. It offers solid coverage with slightly more cost-sharing, including copays for doctor and ER visits and no coverage for Part B excess charges.

These rates reflect standard pricing and can vary slightly depending on the insurer, zip code, tobacco use, and whether household discounts apply.

Over the past year, we’ve observed that rate increases for Medigap plans in New Jersey typically fall between 7% and 10% on average.

While this rate of increase is fairly typical across the Medigap market, buyers should be aware of how premiums may change over time – especially if they’re planning long-term with a fixed retirement budget.

Now, I’m sure you’re thinking that’s a lot. I agree with you, and we’ll talk more about that later.

UnitedHealthcare offers additional features, including the option to enroll in a Renew Active fitness program, similar to SilverSneakers.

They do have dental, vision, and hearing discounts and fairly competitive rates in New Jersey. They are a highly reliable and well-established company with one of the longest track records in the entire Medicare industry.

UnitedHealthcare: Pros and Cons

Let’s break down some pros and cons to help better familiarize you.

| Pros: | Cons: |

|---|---|

| Strong local presence with deep roots in New Jersey’s healthcare system | May have higher premiums compared to national or newer competitors like Aetna |

| Offers popular Medigap plans such as Plan G, Plan N, and High-Deductible Plan G | No drug coverage included, requiring a separate Part D plan for prescription medications |

| Strong relationships with hospitals and doctors statewide | Fewer value-added perks like fitness programs or virtual health support compared to some national carriers |

| Known for responsive local customer service and dedicated Medicare support teams |

UnitedHealthcare: My Opinion

I think UnitedHealthcare is one of the top Medigap options in New Jersey. With around 32% of the national market, they bring a lot of experience and stability to the table.

Their premiums aren’t the cheapest, but they’re competitive for the area and come with a solid reputation.

What really makes UnitedHealthcare stand out is the extra value they offer. Their Renew Active fitness program is a nice perk, and the discounts on dental, vision, and hearing help fill in some coverage gaps.

UnitedHealthcare’s reliable customer service, and its partnership with AARP makes its tools and resources easy to use. If you’re looking for dependable coverage with great support and extras, UnitedHealthcare could be a good fit.

#2. Horizon Blue Cross Blue Shield of New Jersey

Horizon Blue Cross Blue Shield of New Jersey lands at #2 on my list.

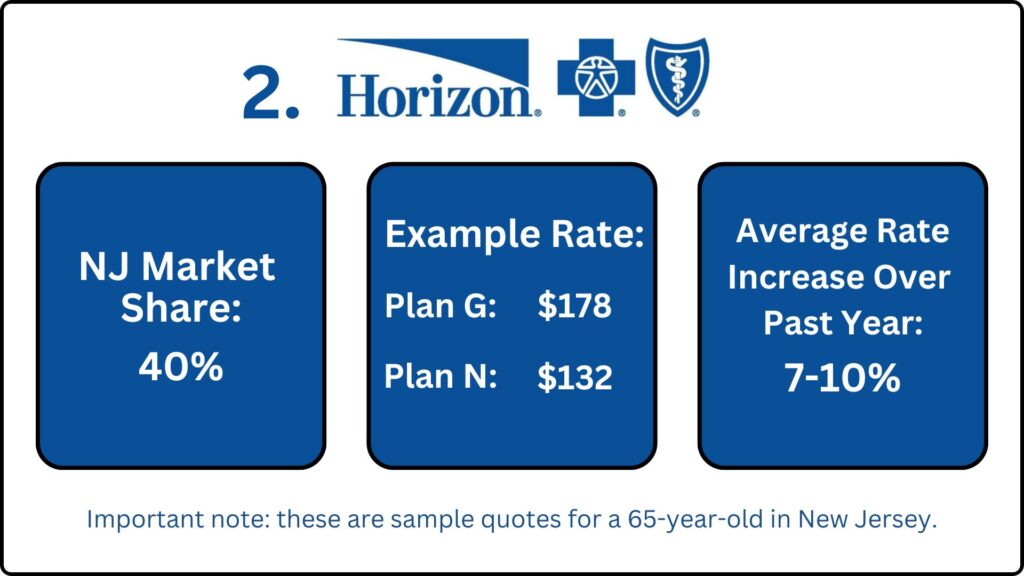

Their market share for all products is roughly 40%. I believe that they have a market share covering around 120,000 people in the state, which makes them a fairly large player compared to others.

Note: This market share data is specific to New Jersey itself.

For a 65-year-old male in New Jersey, sample Medigap rates with Horizon Blue Cross Blue Shield currently show Plan G at approximately $178 per month, while Plan N is around $132 per month.

These rates fall within the expected range for the state and reflect Horizon’s solid position in the local Medigap market.

Over the past year, rate increases have remained fairly typical, averaging between 7% and 10%, which aligns with broader trends across other insurers.

Horizon Blue Cross offers a few nice perks that enhance the value of their plans. Members have access to Blue365, an exclusive savings and discount program offering deals on wellness services, fitness products, and health-related retailers.

They also provide the Horizon Blue app, which lets members manage their benefits and access plan details on the go. While not groundbreaking, it’s a convenient tool for those who like having quick access to their coverage info.

Additionally, Horizon does not charge any membership or application fees, which is a small but welcome benefit compared to some competitors (like Aetna) that may include extra costs during enrollment.

They also offer a premium discount when using auto-pay, which basically means having your monthly premium automatically deducted from a checking or savings account.

Horizon Blue Cross Blue Shield: Pros and Cons

Here are some pros and cons of Horizon BCBS:

| Pros: | Cons: |

| Strong local presence with deep roots in New Jersey’s healthcare system | May have higher premiums compared to national or newer competitors like Aetna |

| Offers popular Medigap plans such as Plan G, Plan N, and High-Deductible Plan G | No drug coverage included, requiring a separate Part D plan for prescription medications |

| Strong relationships with hospitals and doctors statewide | Fewer value-added perks like fitness programs or virtual health support compared to some national carriers |

| Known for responsive local customer service and dedicated Medicare support teams |

Horizon Blue Cross Blue Shield: My Opinion

Horizon Blue Cross Blue Shield of New Jersey is an excellent choice for Medigap coverage, especially if you prefer a local, well-established provider. With a market share covering about 120,000 people, Horizon has strong ties to New Jersey’s healthcare providers.

Their rates are in line with state averages, and recent rate increases have stayed within the expected 7%-10% range. This stability, paired with its reputation for responsive local customer service, makes Horizon a dependable option.

Their perks might not be as flashy as some big-name carriers, but they offer great value. With no membership or application fees and a premium discount for using auto-pay, Horizon keeps things affordable. If you’re looking for reliable Medigap coverage with local ties and a no-nonsense approach, Horizon is definitely worth a look.

#3. Aflac

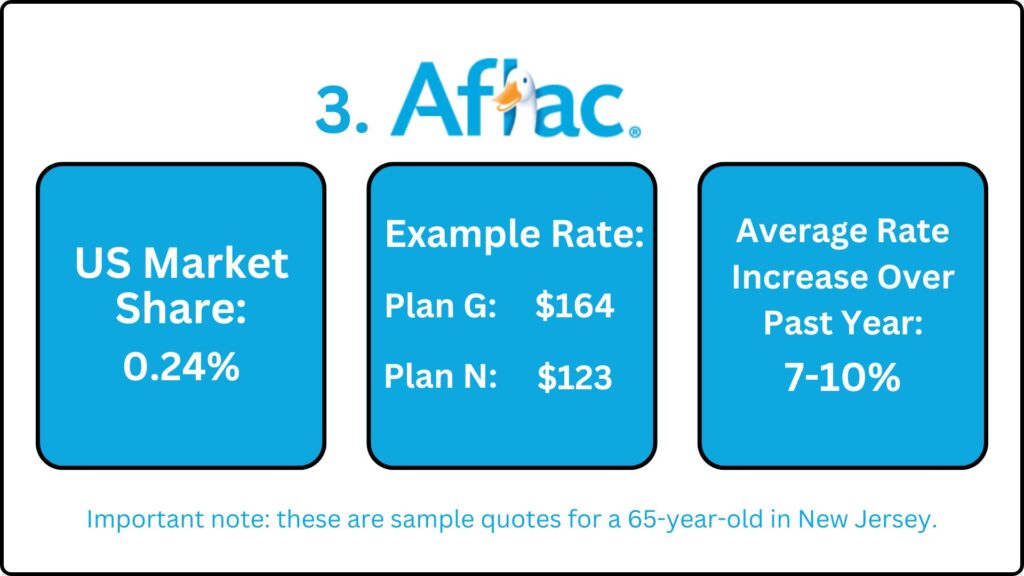

Next up at #3 on my list is Aflac. Aflac is fairly new to the Medicare Supplement market, but it’s gaining a lot of attention because its monthly premiums are lower than those of UnitedHealthcare and Horizon.

Let’s take a look.

You can see their US market share is very small. Again, I mentioned that they’ve just started in the Medicare Supplement space within the last couple of years.

For a 65-year-old man in New Jersey, Aflac’s Medigap rates are pretty competitive. Plan G costs around $164 a month, while Plan N is about $123 a month – both lower than what many other carriers in the state charge. That makes Aflac a great value option.

I’ve ranked them third on my list because, while they’re newer to the Medicare Supplement market, they’ve been a trusted name in supplemental insurance for decades, especially for things like disability, accident coverage, and hospital indemnity.

Moving into Medigap seemed like a natural step, and so far, they’re doing a good job. Their rate increases have been in line with industry averages – typically around 7% to 10% per year – which shows some stability for long-term policyholders.

When it comes to features, Aflac keeps things straightforward. They offer four standardized Medigap plans, including the popular Plan G and Plan N.

While they don’t include many extra perks, they do provide a household premium discount to help eligible applicants save some money, plus 24/7 customer service. That might not be groundbreaking, but it’s a nice option for anyone who values round-the-clock support.

Overall, Aflac offers a solid mix of affordability, a trusted name, and the essential plans most people need. It’s a smart choice for budget-conscious Medicare beneficiaries who don’t need many extras.

Aflac: Pros and Cons

Here are some pros and cons for Aflac:

| Pros: | Cons: |

| Offers all standardized Medigap plans | Limited track record in the Medigap space compared to more established Medigap insurers |

| Competitive pricing for some plans in New Jersey, especially for non-smokers and healthy applicants | Does not include dental, vision, or hearing coverage; these services must be purchased separately |

| Backed by a nationally recognized brand with a strong reputation for supplemental insurance | No Part D prescription drug coverage included – requires a separate drug plan |

| Simple, straightforward enrollment process with digital support |

Aflac: My Opinion

Aflac is making waves in the Medicare Supplement market, especially for New Jersey residents looking for lower premiums without cutting corners on quality. While they’re new to Medigap, Aflac has been a trusted name in supplemental insurance for years, so this move makes sense.

Their Plan G and Plan N premiums are some of the most competitive in the state, making them a great pick for budget-conscious shoppers.

Although they don’t offer as many extras as some bigger carriers, Aflac keeps it simple with affordable coverage, an easy enrollment process, and 24/7 customer service.

Plus, their household discount provides even more savings, making them a solid option for those who want straightforward, cost-effective plans.

While they don’t have the long-standing reputation of companies like UnitedHealthcare or Horizon Blue Cross just yet, Aflac is quickly building credibility and is definitely worth considering for a Medigap plan.

#4. Cigna

Last but not least, Cigna comes in at #4.

We’ve offered Cigna here in my office for seven years now. Cigna has been very steady and consistent in the Medicare Supplement space. I know that they’ve had some changes and some challenges on the Medicare Advantage side, but that’s completely separate from the Medicare Supplement side.

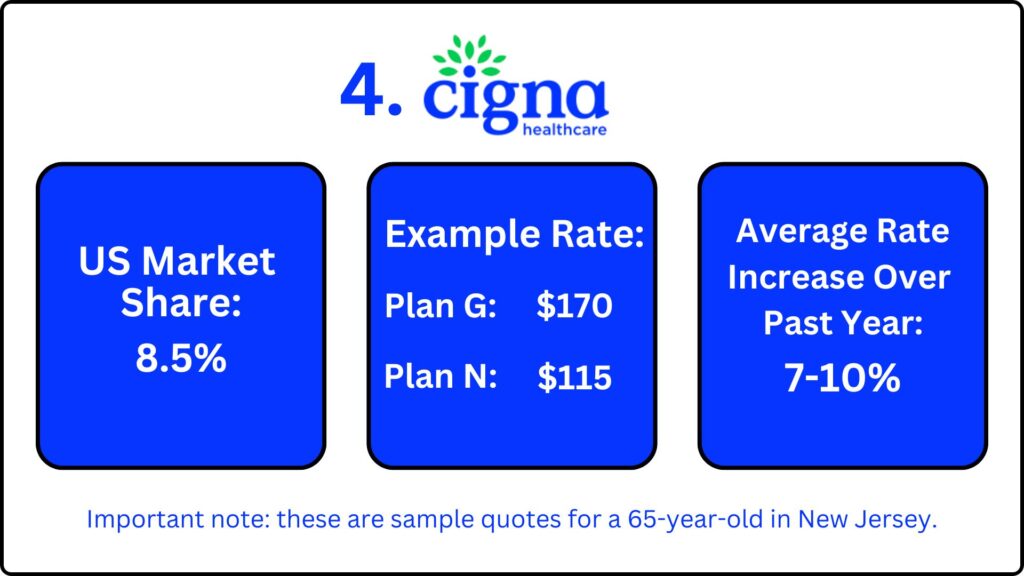

They have a slightly higher nationwide market share than, let’s say, Aflac, just because they’ve been in the Medicare Supplement space much longer. Their national market share is around 8.5%.

For a 65-year-old male in New Jersey, Cigna’s Medigap rates are competitive, with Plan G priced at around $170 per month and Plan N at approximately $115 per month.

These rates are in line with what we’re seeing across the state and reflect solid value given the benefits offered.

Over the past year, their average rate increase has fallen within the typical 7% to 10% range, which suggests a level of premium stability that’s important for anyone planning their long-term healthcare budget.

What really stands out about Cigna is its additional dental and vision coverage offerings.

While these benefits aren’t included in the base Medigap plan and do require an additional premium, they’re well-rounded offerings that go beyond basic cleanings or eye exams.

For those looking to bundle their supplemental coverage, it’s a valuable option.

They also provide a household discount for spouses applying together, a nice way to save on monthly costs.

Additional perks include access to the Active&Fit fitness program, which supports physical wellness and is similar to SilverSneakers.

For those looking for more budget flexibility, they offer a High-Deductible Plan G as well – an option I’ll cover in more detail later, but it’s a great way to keep premiums low while still securing strong protection.

Cigna: Pros and Cons

Here are some pros and cons of Cigna:

| Pros: | Cons: |

| Strong national presence and long-standing reputation in the health insurance industry | Premiums can be higher than newer entrants in the market, like Aflac, depending on zip code and age |

| Offers popular plans like Plan G and Plan N, with competitive pricing in many parts of the state | Dental, vision, and hearing coverage not included – requires separate policies or third-party plans |

| 7% household discount available for eligible applicants | Part D prescription drug coverage is not bundled and must be purchased separately |

| Known for stable rate increases and predictable pricing compared to some competitors | May not offer as many wellness perks or fitness programs as other Medigap providers |

| Easy-to-use customer support and online tools for managing your policy | |

| Guaranteed renewable coverage as long as premiums are paid on time |

Cigna: My Opinion

In my opinion, Cigna is a reliable option for Medigap coverage in New Jersey. We’ve been offering their plans for over seven years, and their performance in the Medicare Supplement market has been consistently solid.

While their Medicare Advantage plans have had ups and downs, that hasn’t affected their steady and dependable Medigap offerings. With a national market share of 8.5%, Cigna is one of the more established Medigap providers, especially compared to newer entrants like Aflac. Their rates are competitive and offer good value.

I particularly appreciate how Cigna offers solid dental and vision plans that can be bundled with Medigap for a separate premium, which is great for those wanting comprehensive coverage without juggling insurers.

Their household discount is ideal for couples, and the included Active&Fit fitness program is a nice perk for wellness-focused customers.

Overall, Cigna is a well-rounded, trustworthy choice with reliable coverage and strong customer support.

Quick Recap

As I said in the beginning, all benefits are the same no matter which company you pick.

It’s going to boil down to who offers the most competitive monthly premium and who offers additional features or benefits, like dental options, vision, or a discount on the monthly premium. That’s really going to be the differentiator.

- When you’re looking at, let’s say, the popular Medigap Plan G or Plan N, all the features of those plans will be the same no matter which company you pick.

Right now, we’re not seeing much variation among the companies. The rate increases seem to be about the same as those additional ancillary benefits.

Now that we’ve covered the best companies – let’s take a look at the best Medigap plans available in New Jersey.

What’s the Most Popular Medigap Plan in New Jersey?

The two most popular plans in New Jersey are Plan G and Plan N.

Hands down, Plan G is going to be #1, with well over 5 million members enrolled nationwide across all of the companies combined.

#2 is Plan N, which has roughly 1.4 million members nationwide throughout all of the companies’ enrollment.

Let’s pause for a moment to focus on these two plans. The primary difference between them lies in cost and coverage. As mentioned earlier, Plan N typically has a lower monthly premium compared to Plan G.

This difference in cost is due to a few key distinctions between the two plans. With Plan G, there are no copays – it covers all deductibles and copays under Original Medicare, except for the Part B deductible.

Plan N, on the other hand, requires some out-of-pocket payments, which is why its premiums are more affordable.

If you have Plan G, you’ll need to cover the Part B deductible each year. For 2025, that deductible is set at $257. Once you’ve paid the deductible, Plan G takes care of everything Medicare doesn’t cover, ensuring you’re fully protected moving forward.

If you have a hospital deductible with Medicare, need outpatient testing, have office visits, or other costs that Original Medicare doesn’t fully cover, Plan G has you covered.

Plan N, on the other hand, comes with lower premiums, but there’s a bit of a trade-off. With Plan N, you’re still responsible for the annual Part B deductible, which is $257. You’ll also have a $25 copay for each office visit and a $50 copay for emergency room or urgent care visits.

These extra out-of-pocket costs are the reason Plan N’s premiums are lower compared to Plan G.

Keep in mind that depending on your age, location, and insurance provider, the premium difference between Plan G and Plan N might not be huge. In that case, going with Plan G could make more sense since it removes the hassle of keeping track of copays, which can add up over time.

In the end, it’s all about figuring out which plan works best for your needs and budget.

What About the Medigap Rate Increases?

Let me move on to the most asked question, which is rate increases. I covered those briefly when I went over each company.

Historically, we have seen rate increases of around 3 to 4% per year on average. That is very favorable, very generous. When the COVID-19 pandemic began, many people without urgent medical needs or emergencies chose to delay seeking care or treatment.

So, a vast majority of people held off on medical care during COVID and quarantine and delayed getting that testing, surgery, or treatment done.

When COVID settled down, there was a massive influx of people who returned to the medical doctors and hospitals to now get that delayed care treated. That basically created an influx or a tidal wave all at one time. And that is why we’re seeing a rate increase in the 7% to 10% range.

The hope is, is that once these post-COVID claims calm down, these rate increases will also go back down to more favorable amounts. That is the future hope going forward with rate increases with all companies.

Does Medical History Affect Medigap Prices in New Jersey?

Yes, medical history can affect Medigap prices in New Jersey, but it depends on the timing of your application.

If you apply during your Medicare Supplement Open Enrollment Period – which begins the month you are both 65 or older and enrolled in Medicare Part B – your medical history does not impact your ability to get coverage or the price you pay.

During this six-month window, insurance companies are required to accept your application regardless of pre-existing conditions, and they must offer you the standard rate for any Medigap plan available in your area.

Similarly, if you’re applying under a guaranteed issue right, such as losing employer-sponsored coverage, insurers cannot deny you a policy or charge more based on your health.

However, if you apply outside of these protected periods, most insurers in New Jersey can use medical underwriting to evaluate your health history. This means they can ask health-related questions, consider your past or current medical conditions, and potentially increase your premium, impose waiting periods, or even decline coverage altogether.

New Jersey does have one important consumer protection: the state requires continuous open enrollment for Medigap Plan A, meaning you can apply for that specific plan at any time without being denied due to health issues.

But if you’re interested in more comprehensive plans like Plan G or Plan N, underwriting may still apply outside your initial enrollment window.

In a nutshell: While your medical history won’t impact Medigap pricing if you apply during your Open Enrollment or a guaranteed issue period, waiting too long can lead to higher costs or limited availability.

It’s usually best to apply as soon as you become eligible to avoid these potential issues.

Do Medigap Plans in New Jersey Cover Dental, Vision, or Prescriptions?

No, Medigap plans in New Jersey do not cover dental, vision, or prescription drugs.

Like Medigap plans in other states, New Jersey’s Medigap policies are designed to cover the gaps in Original Medicare, such as deductibles, copayments, and coinsurance. However, they do not include coverage for routine dental care, vision services, hearing aids, or outpatient prescription drugs.

If you want coverage for these services, here are your options:

For Prescription Drugs:

You’ll need to enroll in a separate Medicare Part D prescription drug plan. These plans are offered by private insurance companies approved by Medicare and are designed specifically to cover the cost of medications.

For Dental and Vision Coverage:

You can purchase standalone dental and vision insurance plans from private insurers. Many companies – such as Ameritas, Aetna, and Cigna – offer plans that cover preventive care (like exams and cleanings) as well as major services (like crowns or dentures), and some plans also include vision benefits for eye exams, glasses, or contact lenses.

Let us know if you’d like help comparing dental or drug plans that work alongside your Medigap policy – we’d be happy to help.

Medigap vs. Medicare Advantage: Which Is Best in New Jersey?

When comparing Medigap and Medicare Advantage in New Jersey, Medigap often stands out as the better long-term choice for many seniors – especially those who value flexibility, consistent coverage, and nationwide access to care.

Medigap works alongside Original Medicare to cover the out-of-pocket expenses that Medicare doesn’t pay – like deductibles, coinsurance, and copays. While monthly premiums for Medigap are generally higher than those of Medicare Advantage plans, many find that the predictable costs and minimal medical bills make it worth the investment.

Plans like Medigap Plan G offer nearly complete coverage. You can see any doctor or hospital in the U.S. that accepts Medicare without worrying about networks, referrals, or surprise bills. This makes it an excellent option for those who travel, split time between states, or simply want access to top-tier hospitals and specialists, including those in neighboring New York and Pennsylvania.

On the other hand, Medicare Advantage plans in New Jersey may seem attractive with their lower premiums (sometimes even $0) and extra perks like dental, vision, and gym memberships. But these plans often come with limitations.

You’ll typically need to stay within a provider network, get referrals to see specialists, deal with prior authorizations, and navigate annual changes to coverage, formularies, or provider lists. Out-of-pocket costs can also add up quickly if you have frequent medical needs and access to care outside your region can be difficult.

If you’re looking for peace of mind, Medigap provides more stability, better access to providers, and fewer unexpected healthcare costs.

While Medicare Advantage might work well for those on a budget with fewer health needs, Medigap is often the more reliable, travel-friendly, and all-around comprehensive option – especially if you’re planning for long-term medical care.

Bottom Line: My Advice

If you’re reading this and have decided not to get a Medicare Advantage plan, I commend you. Medigap is far superior to any Medicare Advantage plan. There are no prior authorizations, referrals, plan changes, or loss of doctors and hospitals.

When searching for the right plan, it’s important to be cautious, as there’s a lot of bias surrounding people’s experiences with different companies and plans. That said, customer service satisfaction isn’t a major concern when it comes to Medigap. Typically, Medicare covers its portion of the costs, and the Medigap plan seamlessly pays the rest.

Unlike Medicare Advantage, Medigap doesn’t rely on networks or prior authorizations, which means fewer complexities and less need to contact customer service. Most interactions with Medigap carriers involve straightforward tasks like updating your address, adjusting payment methods, questioning a premium change, or canceling the plan entirely.

Claim issues are rare with Medigap, so you’ll likely have little reason to contact your provider unless it’s for administrative updates or minor inquiries.

Again, when you’re comparing plans, it’s essential to prioritize the actual plan benefits. Also, remember you are protected with guaranteed issue rights if a Medicare Supplement company should become insolvent or go out of business.

If you’ve made the choice to pick a Medicare Supplement plan and you’ve closed the door on the idea of a Medicare Advantage, you are already way ahead of the game, and you are doing the best possible thing for you, your healthcare, and your finances.

If you have any questions about what I’ve covered, feel free to reach out to us. If you’d like us to conduct a needs analysis, the process is simple: give us a call, share your situation, and we’ll gather the necessary details. We’ll ask a few key questions to identify which company or plan best suits your needs, then present tailored recommendations designed just for you.

FAQs

UnitedHealthcare ranks highest due to its large market share, national presence, and added benefits like Renew Active fitness programs and discount perks. However, Horizon Blue Cross Blue Shield, Aflac, and Cigna also offer competitive rates and unique features worth considering.

Plan G covers everything except the Medicare Part B deductible ($257 in 2025), with no copays. Plan N has a lower premium but includes a $25 copay for office visits and up to $50 for ER or urgent care, in addition to the Part B deductible.

Yes. All carriers experience annual rate increases. For 2025, most companies in New Jersey have had average increases between 7–10%, largely due to post-COVID surges in delayed medical care and claims.

Yes. Medigap benefits are standardized by law, meaning Plan G from one company offers the same medical coverage as Plan G from another. Differences come down to premium price, rate history, and additional perks like discounts or fitness programs.

You’re protected. If a Medicare Supplement company becomes insolvent or stops offering coverage, you have a guaranteed issue right to switch to another Medigap company without answering health questions. This ensures you’re never left without coverage, even in a worst-case scenario.