Medicare Supplement Plan Comparisons Chart for 2025

Medicare Supplement insurance – often called Medigap – continues to be a critical tool for millions of retirees who want more predictable healthcare expenses.

If you’re new to Medicare or re-evaluating your coverage in 2025, understanding how Medigap plans work and which options are most viable this year can help you make a smart, informed decision.

In 2025, two plans stand out: Plan G and Plan N. These have become the go-to choices for new enrollees, especially since Plan F, the once-dominant option, stopped accepting new beneficiaries in 2020.

However, other plans are still out there, and it’s important to know what’s available and why certain plans are more popular.

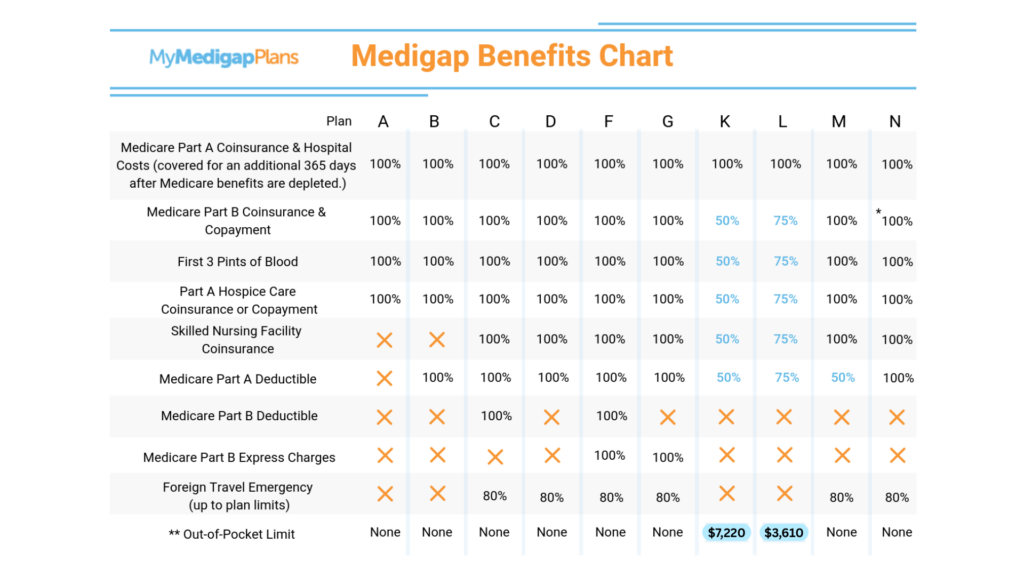

Below, we will analyze a Medicare Supplement comparison chart and then break down your choices in an informative, user-friendly way.

*Except for copayment for some office and emergency room visits that do not result in an inpatient admission.

**After you meet your out-of-pocket limit and annual Part B deductible, your Medigap plan will pay for covered services at 100% for the remainder of the calendar year.

Remember: Not all Medigap plans on the comparison chart are offered by every state, and will also vary depending on the insurance company.

What Are Medigap Plans and Why Do They Matter?

Medigap plans are private insurance policies designed to fill the “gaps” in coverage left by Original Medicare (Parts A and B).

These gaps include out-of-pocket expenses like deductibles, coinsurance, and copayments, as well as services that Medicare doesn’t fully cover, such as emergency care during international travel.

Original Medicare pays for many healthcare services and supplies, but it doesn’t cover everything.

For example:

- It leaves a $1,676 deductible per benefit period for hospital stays (Part A)

- It requires a 20% coinsurance for outpatient services under Part B, with no annual limit

- It doesn’t cover prescription drugs, long-term care, hearing aids, vision, or dental

- There’s no annual cap on how much you might have to spend out of pocket

For someone with frequent medical needs or simply wanting peace of mind, these gaps can lead to high, unpredictable costs. That’s where Medigap comes in.

Medigap plans, sold by private insurers, are designed to fill those gaps. These plans are standardized across most states, meaning that Plan G from one insurer offers the same benefits as Plan G from another.

The pricing, rate history, financial stability of the insurer, and underwriting rules vary.

There are 10 standardized Medigap plans: A, B, C, D, F, G, K, L, M, and N. However, only a few of these are widely used or recommended in 2025.

How Medigap Works

Medigap policies work alongside Original Medicare. When Medicare approves a claim, it pays its share first.

Your Medigap policy then kicks in and covers some or all of the remaining costs, depending on your specific plan.

Here are a couple of scenarios to help give you an idea.

| #1. Hospital Stay with Medigap Plan G Linda is 68 years old and needs to be admitted to the hospital for pneumonia. She stays for 5 days and receives treatment covered under Medicare Part A. Without Medigap: Medicare Part A deductible (2025): $1,676 Linda pays the entire $1,676 out of pocket before Medicare begins to pay Medicare pays for the rest of her covered stay With Medigap Plan G: Plan G covers the entire $1,676 Part A deductible Linda pays nothing for her hospital stay Result: Medigap Plan G saves Linda over $1,600 for a single hospitalization, ensuring she doesn’t have to pay a large lump sum at a stressful time. |

| #2: Routine Doctor Visit with Medigap Plan N George, a 70-year-old retiree, goes to his primary care doctor for a check-up and follow-up blood work. Without Medigap: Medicare Part B covers 80% of the visit George is responsible for 20% of the Medicare-approved cost Let’s say the approved cost is $150 → George owes $30 With Medigap Plan N: George pays up to $20 for the office visit (Plan N copay limit) Medigap Plan N pays the rest of the Part B coinsurance George’s total out-of-pocket = $20 (even though his coinsurance would’ve been $30) Result: Even though Plan N involves some cost-sharing, George still saves money and avoids unexpected charges. |

These examples highlight several key takeaways about how Medigap works:

- It caps your financial exposure by covering large, unpredictable expenses like deductibles and coinsurance.

- The type of Medigap plan you choose (e.g., G vs. N) determines whether you’ll face small copays or excess charges.

- It offers strong peace of mind for travel and provider choice, especially with nationwide acceptance and foreign emergency coverage.

Now, let’s break down the specifics of each Medigap plan, starting with the most popular.

Plan G: The New Benchmark for Comprehensive Coverage

As of 2025, approximately 14 million Medicare beneficiaries are enrolled in Medigap plans. Plan G accounts for 39% of these, translating to nearly 5.3 million enrollees.

It offers nearly full coverage of Medicare-related expenses, with the exception of the annual Part B deductible, which is $257 in 2025.

What Plan G covers:

- Part A hospital costs and coinsurance

- Part A deductible

- Part B coinsurance and copays

- Part B excess charges (fees some providers charge above the Medicare-approved rate)

- Skilled nursing facility care coinsurance

- Emergency foreign travel medical care (80% up to plan limits)

Plan G is often chosen by people who want to minimize surprise bills and frequently use healthcare services. It’s particularly attractive to those with chronic conditions or who value budgeting consistency.

The cost of Medigap Plan G varies based on factors such as age, location, and insurer. In 2025, the average monthly premiums for Plan G are as follows:

| Age 65: Approximately $143.64 Age 70: Approximately $154.72 Age 75: Approximately $182.09 Age 80: Approximately $212.42 Age 85: Approximately $269.68 |

These figures highlight how premiums tend to increase with age. It’s also important to note that premiums can also vary by location.

For instance, in New York City, premiums for Plan G can range from $306 to $526.85 per month, while in Chicago, they range from $114.17 to $270.76 per month.

While premiums vary based on several factors, the plan’s benefits often outweigh the costs for many individuals seeking comprehensive Medicare supplement coverage.

Plan N: The Budget-Conscious Alternative

While Plan G remains the most popular Medigap option in 2025, Plan N has continued growing, especially among new enrollees comfortable with some minor out-of-pocket costs.

According to the latest available market data, Plan N now accounts for over 1.6 million enrollees nationwide, making it the second-most popular Medigap plan behind Plan G.

What Plan N covers:

- Part A hospital costs and deductible

- Part B coinsurance (with copays)

- Skilled nursing facility coinsurance

- Foreign travel emergency care

Cost-sharing under Plan N includes:

- Up to $20 copay for doctor visits

- Up to $50 copay for emergency room visits (waived if admitted)

- Part B deductible ($257 in 2025)

- No coverage for Part B excess charges

These copays and the lack of excess charge protection are the key trade-offs compared to Plan G. Most providers accept Medicare assignment (meaning they don’t charge excess fees), so this concern may be minimal in practice, depending on your location.

Plan N is widely known for offering lower monthly premiums than Plan G, often saving beneficiaries $20 to $50 per month, depending on the carrier and location.

Here are average premium estimates for Plan N in 2025 (for a 65-year-old non-smoker):

| Age 65: Approximately $110–$135/month Age 70: Around $125–$145/month Age 75: Typically $145–$170/month Age 80+: Ranges from $170–$200/month depending on state and insurer |

However, rates can climb significantly in high-cost areas. For example, in New York City, Plan N premiums range between $270 and $460/month.

Plan N is quickly gaining a reputation as the best value-for-dollar Medigap plan, especially for healthier individuals or those who prefer to avoid high monthly premiums.

Key reasons for its growing popularity:

- Lower premiums than Plan G, often by 10–25%

- Broad national availability with most major insurers offering it

- Appeals to the “newly eligible” Medicare population, especially those turning 65 post-2020, who aren’t eligible for Plan F

However, Plan N is not for everyone. Those with frequent doctor visits or who live in states where excess charges are common (such as California) may want to consider Plan G instead to avoid cumulative out-of-pocket expenses.

Plan F: Still Available, But Only for Some

Plan F used to be the most popular Medigap plan because it covered every Medicare-approved out-of-pocket cost. It remains the most comprehensive Medicare Supplement option available – but only to those who qualify.

Plan F is no longer available to people who became eligible for Medicare after January 1, 2020.

Plan F still holds a significant chunk of the Medigap market, but its dominance is shrinking.

- As of 2025, approximately 6.3 million Medicare beneficiaries remain enrolled in Plan F.

- That represents roughly 45% of all Medigap enrollees, down from over 55% just a few years ago.

- No new enrollments are allowed unless the individual became eligible for Medicare before January 1, 2020.

Plan F’s enrollment decline is primarily due to legislation prohibiting its sale to newly eligible Medicare beneficiaries.

Those already enrolled can keep it, and those eligible before 2020 can still apply – but the pool of people qualifying is gradually getting smaller.

Because Plan F offers the most coverage, it also tends to have the highest premiums among Medigap plans. The cost has also increased faster than for Plans G or N, partly due to an aging risk pool and adverse selection.

Here are the average monthly premiums for Plan F in 2025 (for a 65-year-old non-smoker):

| Age 70: About $175–$210/month Age 75: Typically $200–$240/month Age 80+: Frequently $250–$300/month, with some metro areas exceeding $350 |

In high-cost states like California, Florida, and New York, premiums for Plan F can range from $300 to $500/month, especially among older age groups.

A High-Deductible Plan F (HDF) version is still available in some states, offering lower monthly premiums (typically $50–$90/month) in exchange for a $2,870 annual deductible in 2025.

Note: Because the risk pool is aging and no new younger enrollees are joining, insurers have had to raise premiums faster than with Plans G or N.

Many Plan F policyholders have seen annual rate increases of 8–12%, with some as high as 15% depending on carrier and state.

If you’re eligible to enroll in Plan F and want zero out-of-pocket costs for your medical care, it could still be a great option, provided you’re comfortable with the premiums.

On the other hand, if you’re concerned about cost or seeing large annual rate hikes, it might be worth exploring Plan G or Plan N as more sustainable alternatives.

The Other Plans: A, C, D, K, L, and M

While most of the attention in the Medigap market goes to Plans G and N, and to a lesser extent, Plan F, other standardized Medicare Supplement plans are still available in most states.

These are Plans A, C, D, K, L, and M. They provide a range of benefits and price points, but they make up a relatively small portion of the market.

If you’re wondering whether one of these lesser-known plans might be right for you, here’s what you need to know.

Plan A: The Bare-Bones Option

Plan A is the most basic Medigap plan. It covers only the required core benefits and excludes coverage for the Part A deductible, skilled nursing care, and other common gaps.

Coverage includes:

- Part A hospital coinsurance

- Part B coinsurance/copays

- First three pints of blood

- Part A hospice care coinsurance/copays

Coverage excludes:

- Part A deductible

- Part B excess charges

- Skilled nursing facility coinsurance

- Foreign travel emergency coverage

Premiums are typically lower than all other plans, ranging from $80 to $150/month, depending on age and state.

Plan A is used primarily in states that require insurers to offer it, especially to individuals under 65 on Medicare due to disability.

It represents less than 2% of total Medigap enrollment in 2025 and is not a strong value for most people due to its limited benefits.

Plan C: Closed to New Enrollees

Plan C was once a close alternative to Plan F, offering nearly identical coverage, except it doesn’t cover Part B excess charges.

However, like Plan F, it was discontinued for people who became eligible for Medicare on or after January 1, 2020.

Premiums for Plan C are similar to Plan F, ranging from $160 to $220/month, depending on age and location.

Plan C continues to have a small legacy base, mostly among those who enrolled before the 2020 eligibility cutoff. It now accounts for under 5% of Medigap policyholders and continues to decline.

Plan D: Overshadowed by Plan G

Plan D provides solid coverage but is overshadowed by Plan G, which covers one additional benefit – Part B excess charges.

Because of this, Plan D is rarely recommended unless offered at a significantly lower premium.

Coverage includes:

- Part A deductible

- Part B coinsurance/copays

- Skilled nursing facility coinsurance

- Foreign travel emergency

Excludes:

- Part B deductible

- Part B excess charges

Plan D is only offered by a limited number of insurers. In 2025, it represents well under 1% of current Medigap sales and has not seen much growth.

Plan K: The High Cost-Sharing Plan

Plan K offers partial coverage of most benefits – 50% instead of full coverage – in exchange for significantly lower premiums.

It also includes an annual out-of-pocket limit ($7,220 in 2025), which caps total spending.

Coverage includes:

- 50% of Part A deductible, hospice coinsurance, Part B coinsurance, and blood costs

- 100% of Part A hospital coinsurance

- Annual out-of-pocket maximum ($7,220 in 2025)

Premiums are among the lowest available, ranging from $40 to $90/month.

Plan K is used mostly by extremely cost-sensitive enrollees who want catastrophic protection. It represents about 0.5% of the Medigap market and may appeal to healthier beneficiaries who are okay with higher out-of-pocket risk.

Plan L: More Generous Than K, Still Niche

Plan L is similar to Plan K but covers 75% of most Medicare-approved costs rather than 50%. It also includes a lower out-of-pocket maximum ($3,610 in 2025).

Coverage includes:

- 75% of Part A deductible, hospice coinsurance, Part B coinsurance, and blood costs

- 100% of Part A hospital coinsurance

- Annual out-of-pocket maximum ($3,610 in 2025)

Premiums are slightly higher than Plan K, typically $70 to $120/month.

Like Plan K, Plan L is available in fewer states and has very limited enrollment. As of 2025, it accounts for less than 0.5% of all Medigap policies in force.

Plan M: Partial Deductible Sharing, Low Popularity

Plan M was designed as a mid-range option that splits the Part A deductible with the beneficiary (50% paid by the plan), while covering other core benefits.

It excludes excess charges and Part B deductible coverage.

Coverage includes:

- 50% of the Part A deductible

- Part B coinsurance

- Skilled nursing facility coinsurance

- Foreign travel emergency

Excludes:

- Part B excess charges

- Part B deductible

Premiums are moderate, typically between $110 and $150/month, depending on geography.

Plan M is offered by a small number of insurers and remains extremely rare. In 2025, it has under 1% of the Medigap market.

Summary

While these lesser-known Medigap plans are still technically available, they occupy small corners of the market for specific reasons:

- Plan A is minimal coverage, typically chosen only when required by regulation.

- Plans C and D are legacy or overshadowed plans largely replaced by G and N.

- Plans K and L offer low premiums but require significant cost-sharing and are rarely selected.

- Plan M is a hybrid option with limited adoption and carrier support.

For most Medicare beneficiaries in 2025, Plan G and Plan N remain more practical and widely available choices.

However, if you’re in a unique financial or health situation – or under 65 and shopping in a state with limited offerings – one of these secondary plans may still be worth exploring.

What About High-Deductible Options?

High-deductible Medigap plans are an alternative for people who want to lower their monthly insurance costs and are comfortable with higher out-of-pocket spending when they need medical care.

These plans work by requiring beneficiaries to pay a substantial annual deductible before the Medigap benefits begin covering costs. In exchange, they offer significantly lower premiums than the standard versions of the same plans.

Only two Medigap plans currently come in high-deductible formats: Plan F and Plan G. Both provide broad coverage for the costs that Original Medicare doesn’t pay, such as coinsurance, copayments, and hospital costs.

The high-deductible versions maintain the same coverage after the deductible is met, making them essentially the same as their standard counterparts but with delayed cost-sharing support.

For 2025, the annual deductible for these high-deductible options is $2,870. This means that before the plan begins to pay, enrollees must cover up to $2,870 in Medicare-approved costs out of their pockets.

Once that amount is met within a calendar year, the plan pays in full for all covered expenses.

The two high-deductible plans differ slightly in terms of eligibility and benefits. High-Deductible Plan F is only available to individuals eligible for Medicare before January 1, 2020.

This restriction is due to changes brought on by the Medicare Access and CHIP Reauthorization Act (MACRA), which barred new Medicare enrollees from purchasing any plan that covers the Medicare Part B deductible.

Plan F covers this deductible, so it’s restricted to earlier enrollees.

High-Deductible Plan G, on the other hand, is available to all Medicare enrollees regardless of when they became eligible. It covers everything that Plan F does except for the Part B deductible.

Given its broader eligibility and similar structure, HD Plan G is often the high-deductible option of choice for Medicare newcomers who want this setup.

These plans tend to work best for individuals who are generally healthy and don’t anticipate frequent medical visits or procedures. They’re particularly appealing for those who prefer to manage their healthcare costs with a lower, predictable monthly premium and are financially able to handle higher expenses if a major medical issue arises.

These plans function somewhat like catastrophic coverage, offering protection against very high costs without paying for comprehensive first-dollar coverage every month.

However, they may not be the right fit for individuals with chronic conditions or those who expect to need regular medical care, as reaching the deductible could happen quickly, leading to significant annual out-of-pocket costs.

If you’re deciding between a high-deductible Medigap plan and a standard one, the choice largely comes down to how much you’re willing and able to pay upfront versus over time. It’s worth evaluating your expected healthcare usage and financial flexibility to determine if the high-deductible route offers the right balance of affordability and protection.

How to Choose the Right Medigap Plan

Choosing the right Medigap plan isn’t just about picking the one with the most benefits or the lowest price.

It’s about striking a balance between your current and future health needs, your comfort with out-of-pocket expenses, and your ability to pay monthly premiums.

Your choice can also depend on local factors, like whether your state allows certain plans or how many insurers offer them in your area.

Here are some suggestions.

Choose Plan G if:

- You want the broadest coverage available to new enrollees

- You prefer to pay a higher premium in exchange for fewer out-of-pocket surprises

- You see specialists frequently or have chronic conditions

Choose Plan N if:

- You’re in good health and don’t mind occasional copays

- You’re looking to save on monthly premiums

- Your providers accept Medicare assignment (meaning no excess charges)

Avoid lesser-used plans unless you have specific needs or qualify for limited underwriting. Plans like K or L might appeal to extremely budget-conscious enrollees, but most find the cost-sharing too high for the savings.

Ultimately, the right Medigap plan fits both your medical profile and your financial comfort zone. A healthy person in their 65s might lean toward Plan N or a high-deductible option to save on premiums, while someone managing a chronic condition might prefer Plan G’s predictability and fuller coverage.

In all cases, it’s wise to review your current health status, consider your provider preferences, and factor in your immediate budget and long-term expectations about healthcare usage.

Talking to a licensed insurance agent who knows your state’s Medigap market can also help you make a more confident, informed decision.

Additional Considerations

When comparing Medigap plans, it’s easy to focus on monthly premiums alone. While the upfront cost of a plan is important, it’s only one piece of a larger puzzle.

A low monthly rate may seem appealing, but if the plan is tied to a carrier with a history of frequent rate hikes or limited customer service, those savings could evaporate over time.

To make a truly informed decision, it’s essential to look beyond the premium and assess the full scope of what you’re getting.

It’s important to evaluate:

| The insurer’s financial strength: Look for A-rated companies by independent rating agencies such as AM Best, Moody’s, or Standard & Poor’s. A strong financial rating reflects the company’s stability and long-term viability and increases the likelihood that it will be able to pay claims promptly and without issue. Rate increase history: Medigap premiums often increase over time, and some insurers have more aggressive pricing practices than others. Reviewing how often an insurer has raised premiums for specific plans in your state can give you a realistic idea of what you might pay in a few years. A company with a consistent pattern of modest increases is generally more favorable than one with unpredictable or steep annual hikes. Household or multi-policy discounts: Many insurers offer discounts for households where more than one person purchases a policy or for those who bundle with other insurance products. Even a 5–10% discount can make a meaningful difference over a year, especially for couples. Be sure to ask whether these savings are available and whether there are any conditions attached. Access to customer service and online support: Some carriers offer robust digital tools, mobile apps, and 24/7 helplines, while others may have more limited infrastructure. For beneficiaries who value convenience, the ability to view claims, manage billing, or get help quickly online or by phone can enhance the overall experience significantly. Underwriting guidelines if applying outside your guaranteed-issue window: That means insurers can review your health history and potentially deny coverage or charge a higher premium based on preexisting conditions. Different companies have different underwriting guidelines, so if you’re applying later in life or have a complex medical history, it pays to work with an agent or broker familiar with which carriers are more lenient in your state. |

In short, while it’s tempting to compare Medigap plans purely by their premiums, the best choice is one that aligns with your long-term financial outlook, health needs, and expectations for service.

Taking the time to weigh all these considerations can help ensure you select a plan that remains a good fit for years to come.

Who Can Get a Medigap Plan?

To qualify for a Medigap plan, you must be enrolled in Medicare Parts A and B.

The best time to buy a Medigap plan is during the Medigap Open Enrollment Period, a six-month window that starts when you’re 65 or older and enrolled in Medicare Part B.

During this time, you can buy any plan available in your area without medical underwriting, meaning you can’t be denied coverage or charged more due to health conditions.

After this window closes, insurance companies can require medical underwriting, which could result in higher premiums or denial of coverage depending on your health history.

How to Enroll in a Medicare Supplement Plan

Now that you’ve reviewed the Medigap comparison and decided which plan offers the most cost-effective and comprehensive coverage, we can help you begin the enrollment process.

Naturally, that starts with how much it’s going to cost you. Rates vary depending on several factors, including where you live and your specific health insurance company, but we can help you find out what’s offered in your state.

We can also help you compare rates from company to company with our online quote estimate tool or apply for coverage using our toll-free phone line.

We can also share information about Medicare Part D prescription drug plans that provide drug coverage and can be added to a Medicare Supplement.

Bottom Line

If you’re looking for some peace of mind when it comes to healthcare costs in retirement, Medigap can be a game-changer.

Original Medicare leaves you on the hook for things like hospital deductibles, 20% coinsurance for outpatient care, and there’s no limit to how much you could end up spending out of pocket.

That’s where a Medicare Supplement (Medigap) plan comes in – helping cover those gaps so big bills do not blindside you. Private insurers offer these plans and work alongside Medicare to make your healthcare more predictable.

In 2025, Plan G and Plan N are the two standouts. Plan G is the most popular option for new enrollees because it covers almost everything except the small Part B deductible. Plan N is a bit more budget-friendly and still covers a lot, though you’ll have some copays, and it doesn’t cover excess charges.

Plan F used to be the top choice because it paid for everything, but it’s only available if you qualified for Medicare before 2020, and it’s getting more expensive each year.

The other plans (like A, C, D, K, L, and M) are still out there but don’t offer the same mix of value and coverage, so most people skip them.

The right plan for you depends on your health, budget, and where you live. Premiums can vary a lot depending on your ZIP code and the insurance company.

If you’re turning 65 or recently enrolled in Medicare Part B, now’s the best time to sign up – during your six-month Medigap Open Enrollment Period, when insurers can’t deny you coverage based on your health.

Whether shopping for the first time or thinking about switching, it’s worth taking a little time to compare your options and find a plan that fits your needs. A good Medigap plan can greatly affect how confident and comfortable you feel navigating your healthcare.

Article Resources: Types of Medigap Plans | When Can I Apply for a Medicare Supplement Plan? | How Do I Enroll in a Medigap Plan? | When Can I Change Medigap Plans? | Can I Be Denied Medigap Coverage? | CMS Medicare Services